Craft breweries across British Columbia are pushing back against what they call an unfair provincial tax system on beer production.

On July 31, the BC Craft Brewers Guild launched its “Protect BC Craft Beer” campaign, aiming to level the playing field with large foreign-owned companies.

Executive director Ken Beattie said the guild has finally secured a meeting with the ministry of agriculture scheduled for September.

According to Beattie, the current tax system penalizes local breweries for their success, and BC’s official opposition agrees.

“Right now, we have a system that penalizes success. We are actually punishing craft brewers for creating more jobs, more opportunities, more tax revenue, and more demand for agricultural inputs,” said Gavin Dew, BC Conservative MLA.

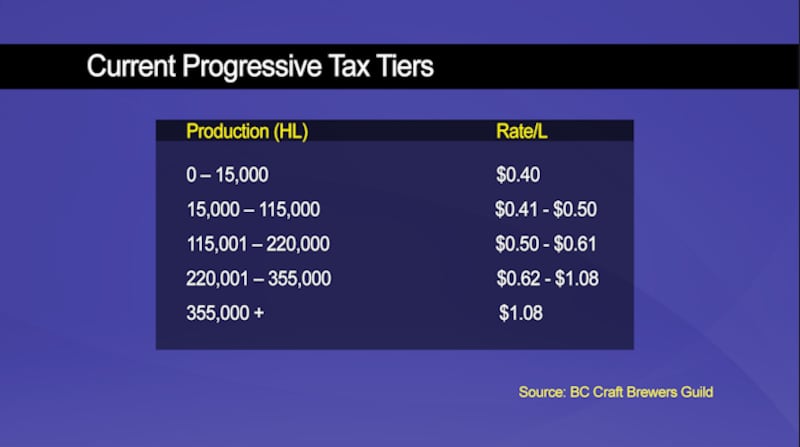

BC beer producers pay $0.40 per liter until reaching the first tier set at 15,000 hectoliters. Beattie noted that level of production compares to 30,000 kegs of beer.

After that, taxes climb progressively to a flat rate of $1.08 per liter for beer companies making 355,000 hectoliters or more annually.

“What we’re asking is for a 75% reduction down to a number that most of our members are making, which is under 2000 hectolitres. Then, we are asking to move the very top to 500,000, which is well below what the world’s largest breweries are making,” said the executive director.

He noted that since the last reform in the industry was 8 years ago, foreign-owned beer companies received $60 million in rebates.

In that same period, no new BC brewery has come close to hitting the first tax markup in a single year.

“We’ve opened 168 breweries since it last changed, and in that time, not one of those breweries made 15,000 hectolitres. In fact, the majority of them will take probably ten years of volume to make that,” said Beattie.

Beattie said the proposal would be revenue neutral for government but would help small breweries grow.

Beattie also added that production costs have significantly increased since the Covid-19 pandemic. He pointed out that other provinces have already made significant changes to support small businesses since the beginning of the U.S. trade war.

“Since Covid, the beer ingredients, aluminum costs, packaging costs, everything’s gone up about 31 precent,” he said.

In Dawson Creek, small businesses are facing added pressure competing with Alberta, which has a more favorable beer tax system.

Clay Drouin, co-owner of Post & Row Brewery Co., said his business has become very successful in the community, but still pays steep taxes for a relatively small amount of production.

“We’ve certainly scaled up in our production, but we’re still very small. So, we are in the lower bracket of markup at $0.40 a liter,” said Drouin.

He said he is hopeful about the guild’s upcoming meeting with the ministry of agriculture.

“If we can make life easier for our membership, in turn, it makes it wonderful for small communities and breweries across the province,” added Drouin.

Meanwhile, the BC Conservative Party criticized David Eby’s government for taking so long to act.

“It shouldn’t take a public opinion campaign for an industry association to get a meeting with the government about an industry that supports 6,000 jobs,” said Dew.

Despite his frustration, Dew said it is significant for the industry to sound the alarm.

“This government is simply not keeping up with a fast-moving marketplace where there’s competition in other provinces,” added Dew.

The BC Craft Brewers Guild noted that buying local is still the best way to support small businesses.

“We need to support independent, not just breweries, but businesses, and keep our dollars local,” Drouin said.